WCTRS advocates fair and just practices in support of the loan trading market. Our committee members strive to preserve a healthy and profitable global market for borrowers and investors.

WCTRS advocates fair and just practices in support of the loan trading market. Our committee members strive to preserve a healthy and profitable global market for borrowers and investors.

Trade finance is the financing of international trade like issuing credit, lending, and exporting credit. The preservation of the trade finance industry depends on every country honoring their international trade agreements and abiding by the same rules.

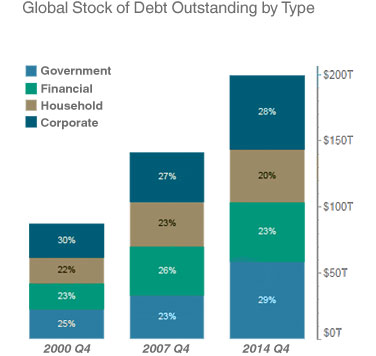

The chart (to your right) examines the growing dependence on financing. Financing isn't limited to domestic entities. Trade finance has opened up a global market extending credit to anyone from anywhere.

For instance, a Chinese company (the exporter) manufacturing products can extend credit to a U.S. entrepreneur (the importer) through a letter of credit. Financial trade services have made global exchange a simple process.